2024 Form 1040 Schedule 5 Fillable – If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule D you will need to complete Form 1040 through line 43 to calculate your . Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the .

2024 Form 1040 Schedule 5 Fillable

Source : www.irs.gov2024 Form 1040 ES

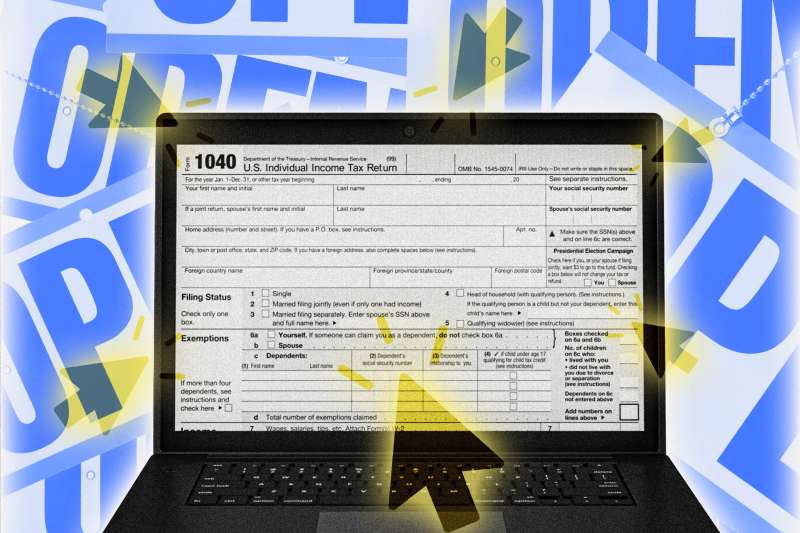

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Free File Now Open for 2024 Tax Season — Do You Qualify? | Money

Source : money.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

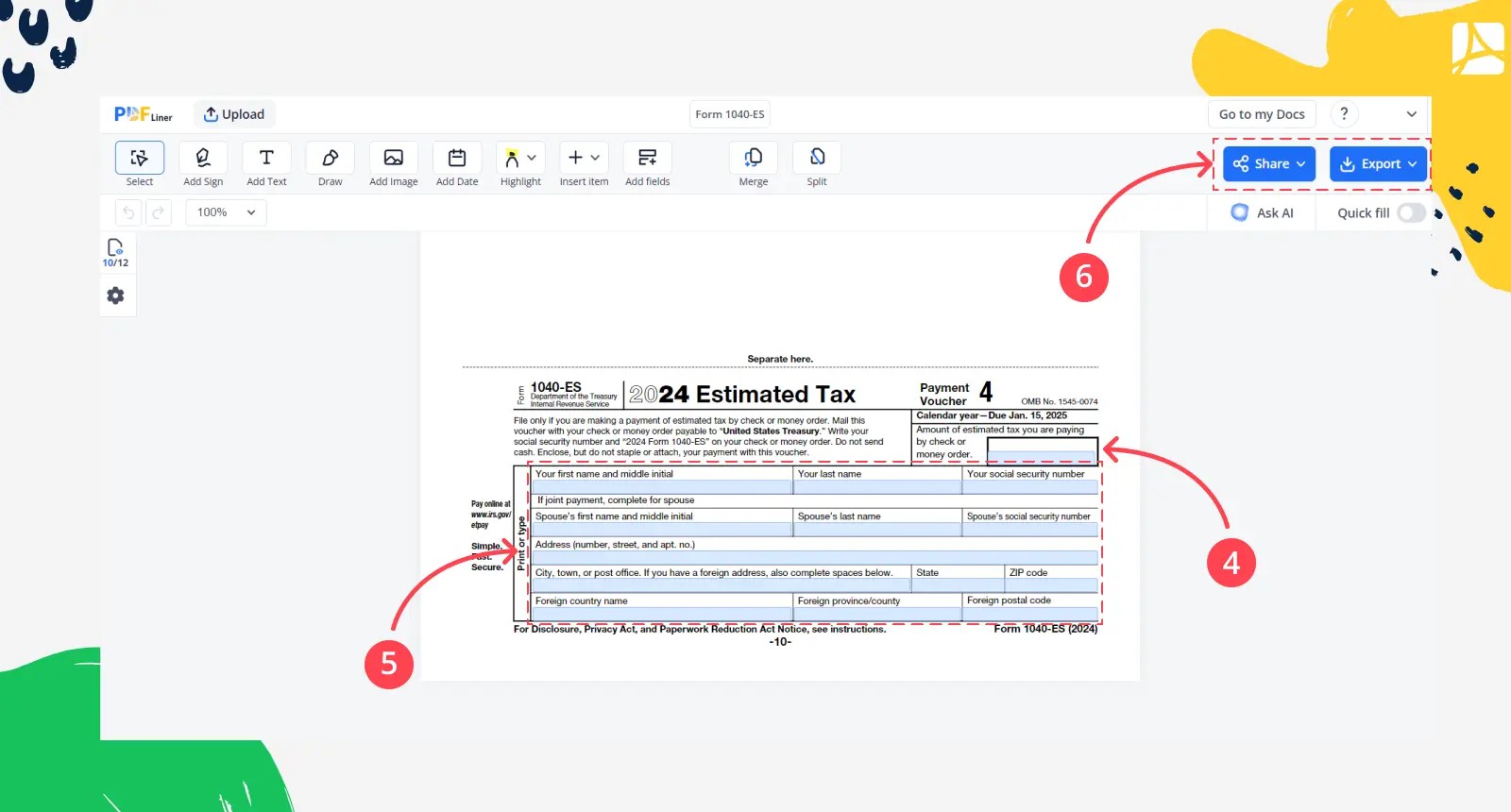

Source : www.dochub.comForm 1040 ES (2024), Print and sign form online PDFliner

Source : pdfliner.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 Schedule 5 Fillable 1040 (2023) | Internal Revenue Service: Gather each tax form you need to fill out for the type of business you own. Sole proprietors may only need the form 1040, Schedule SE for self employment taxes, and Schedule C-EZ for reporting the . Margin loan rates from 5.83% to 6.83% tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are additional .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)